Welcome to the 12th edition of

The premier gathering where innovation meets implementation in the heart of MEA’s rising fintech hub. Building on the resounding success of our 2024 event, PAFIX ‘25 promises to be an unprecedented convergence of financial technology leaders, innovators, and regulators

Powered by “The Central Bank of Egypt”, PAFIX ‘25 promises to be one of the region’s top platforms in the fields of payment, fintech and digital banks. The conference will stand out with top-notch speakers, high-level panelists, and specialized audience, seeking to rewrite together the new financial DNA.

AI IN THE HEART OF THE FINANCIAL SECTOR

Artificial Intelligence is fundamentally transforming financial services across the world. At PAFIX ‘25, we dedicate significant focus to exploring how AI is democratizing financial access, enhancing security, and creating unprecedented opportunities for growth.

Our comprehensive AI in Finance track examines the technological revolution that›s reshaping our financial landscape.

The MENA region is seeing new financial ecosystems built on AI capabilities. From AI-driven financing in rural areas to smart city payment systems in urban centers, these innovations are creating new opportunities and fostering financial inclusion.

This year’s PAFIX places special emphasis on making AI in finance accessible, practical, and relevant to our regional context. Whether you›re a traditional bank looking to modernize, a fintech startup leveraging AI, or a regulatory body adapting to these changes, PAFIX

‘25 provides the knowledge, connections, and insights needed to thrive in this AI-driven financial future.

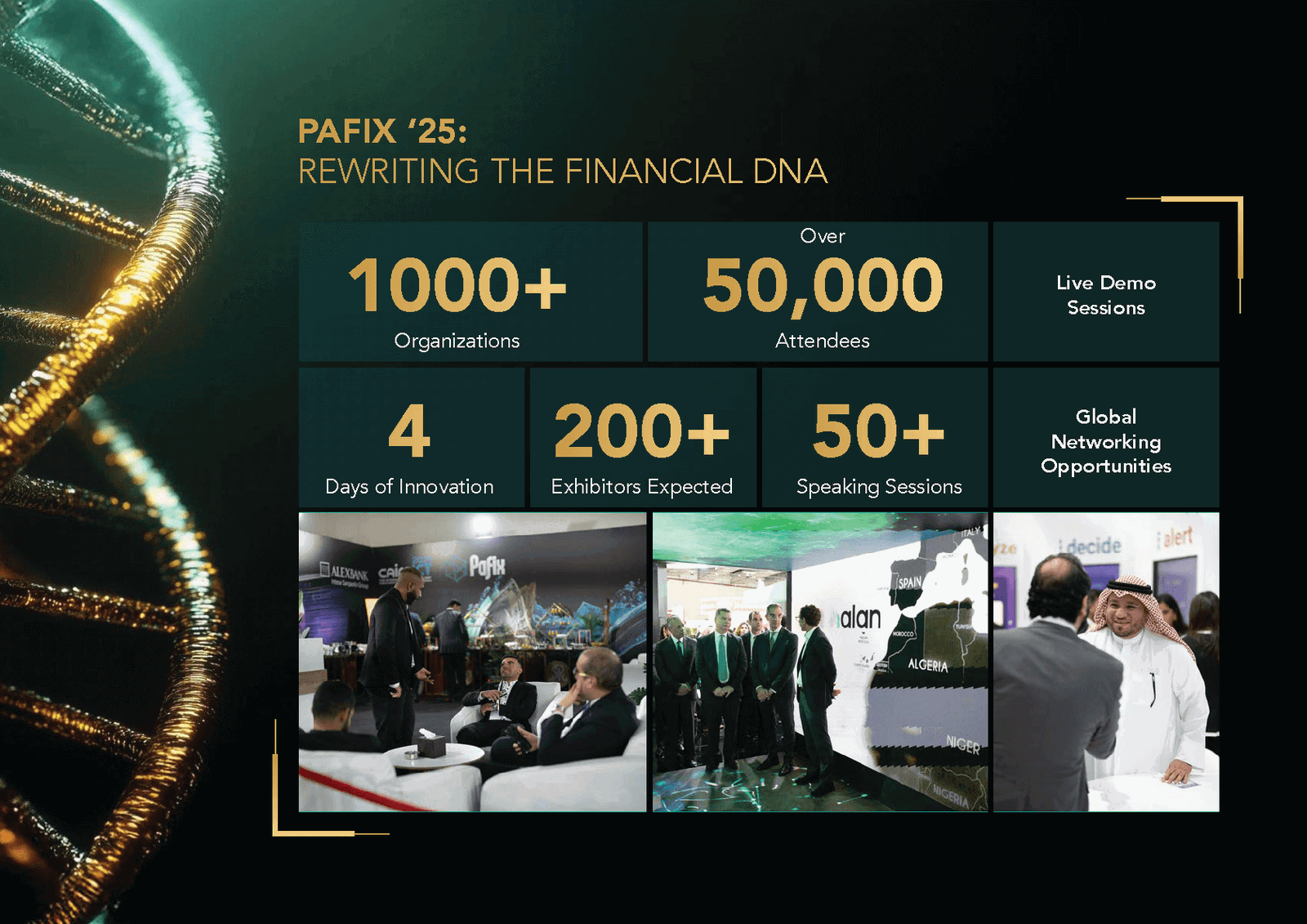

PAFIX Highlights

Get insights from renowned experts and thought leaders who will share their knowledge and experience in the multiple sectors of PAFIX ‘25. Discover the latest trends, challenges, and opportunities shaping the industry.

Explore a vibrant exhibition area featuring cutting-edge products, services, and solutions from leading companies and startups. Engage with exhibitors, network with industry professionals, and witness firsthand technology advancements revolutionizing the payments and fintech landscape.

Participate in engaging panel discussions covering a wide range of topics, including digital payments, e-commerce, digital banks, and innovative approaches to financial inclusion. Learn from industry experts, exchange ideas, and gain actionable insights.

Connect with industry peers, professionals, and decision-makers during dedicated networking sessions. Expand your professional network, forge valuable partnerships, and explore potential collaborations that can drive your business forward.

Witness the excitement as promising start-ups pitch their groundbreaking ideas and solutions to a panel of industry experts and investors. Discover the next big disruptors in the payment and financial inclusion sectors and witness innovation in action.

CONFERENCE PROGRAM

Over three dynamic days, attendees will engage with:

• Keynote presentations from financial leaders

• Panel discussions on regulatory frameworks

• Technical workshops on emerging technologies

• Innovation showcases from leading fintech companies

• Networking sessions with industry pioneers

• Live demonstrations of cutting-edge solutions

WHY PAFIX ‘25?

The financial services landscape is undergoing a fundamental transformation. As traditional boundaries blur and new possibilities emerge, PAFIX ‘25 offers an unparalleled platform to explore, connect, and shape the future of finance. Our carefully curated exhibition space and conference program address the most pressing challenges and opportunities in:

Digital Banking Evolution

Payment Innovation

Open Banking Frameworks

Blockchain & Digital Assets

Artificial Intelligence in Finance

Regulatory Technology (RegTech)

Cybersecurity & Digital Identity

WHO SHOULD ATTEND?

Investment Professionals

Payment Service Providers

Cybersecurity Experts

Rating Agencies

Traditional Banking Executives

Neo-bank Innovators

Financial Technology Providers

THE SIGNIFICANCE OF OUR SLOGAN:

The 2025 slogan «Infinite Possibilities: Rewriting the Financial DNA» is a powerful metaphor that captures key ideas about the transformation in financial services, particularly in the context of PAFIX›s significant domains.

The concept of “DNA” represents the fundamental building blocks and core structures of financial services - how money moves, how value is stored, how transactions occur, and how financial services are delivered and accessed. Just as biological DNA contains the instructions that define how living beings function and evolve, financial DNA encompasses the rules, systems, and infrastructure that govern how our financial world operates.

changes the very essence of how financial

services work. This is particularly relevant in today’s context where technologies like AI, blockchain, and digital platforms are reimagining existing financial services.

speaks of the boundless potential

that emerges when we combine new technologies, innovative thinking, and a commitment to inclusion. In the context of PAFIX, this could manifest in several ways

it is the ability to transfer value instantly

across borders without traditional banking infrastructure, or new payment methods that blend seamlessly with daily life through technologies.

it suggests the continuous emergence of new

business models and services that weren’t possible befor

It represents the potential to bring banking services to the unbanked population through innovative solutions

like mobile banking, AI-driven credit scoring, and blockchain-based identity verification.

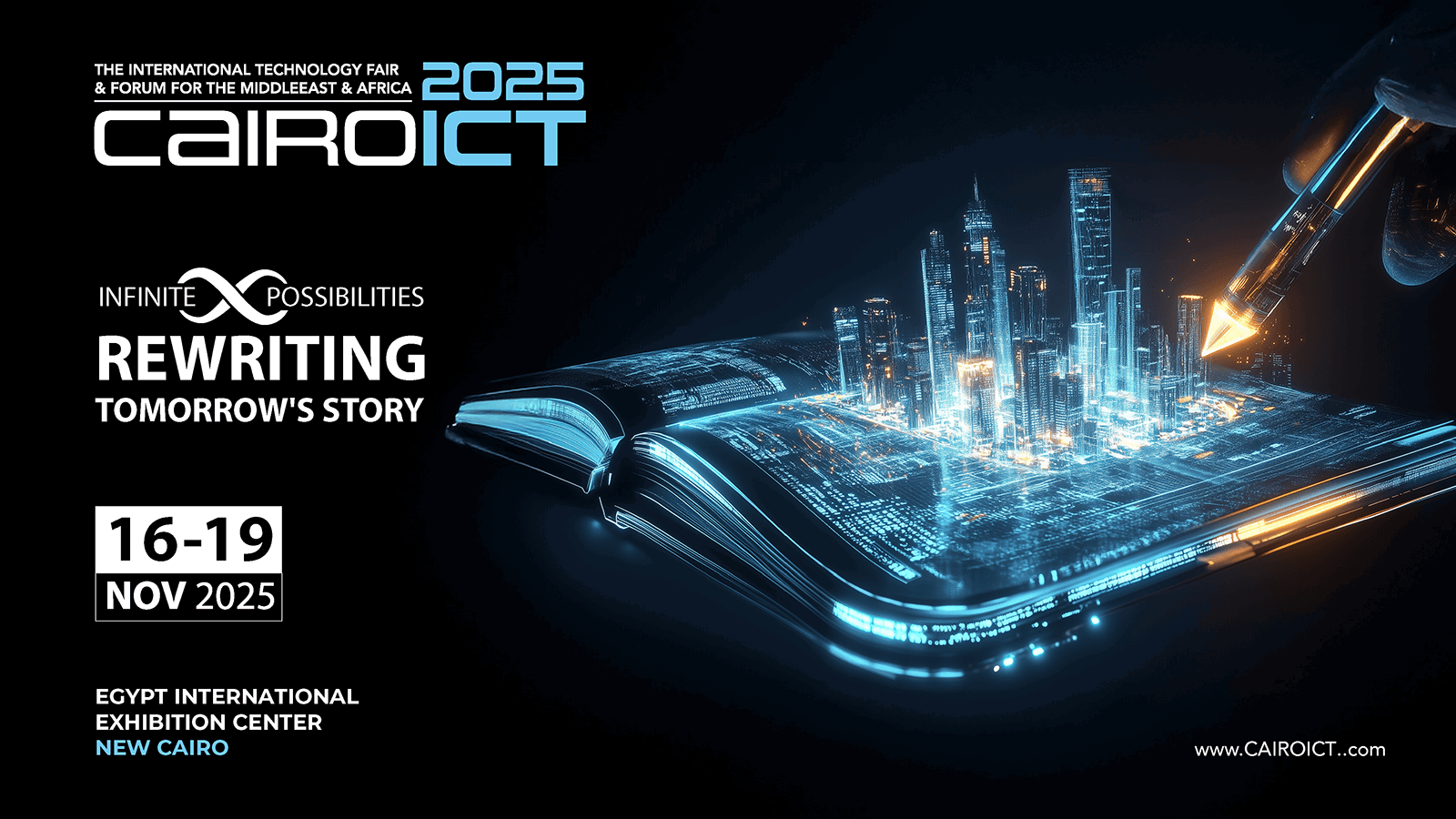

PAFIX and Cairo ICT: A Formula of Success

PAFIX has along the years been conveniently collocated with Cairo ICT – the leading event in Africa and the Middle East and winner of best technology exhibition in Africa in 2022.

The convenience is most importantly based on the presence of technology vendors, integrators, and Mobile network operators. The focus of Cairo ICT ’25 – now in its 29th round is Artificial Intelligence, Cloud Computing (Public Cloud), Data Centers, and Cybersecurity. This go in line with the needs of financial institutions and the fintech industries.

Technology providers will not be just guests, but part and parcel to the joint event, enriching the vibrant exhibition ground and the diverse forums at both ends.

For example, identity solutions by Mobile Network Operators (MNO) leverage the widespread use of mobile phones and the existing infrastructure of mobile network operators to provide digital identity services. These solutions have proven to be effective in improving financial inclusion.

Also, Mobile network operators provide mobile money services that allow users to store and transfer funds using their mobile phones. With MNO identity solutions, individuals can link their mobile money accounts to their mobile phone numbers, creating digital wallets tied to their identity, shortening the way for the overall objective.

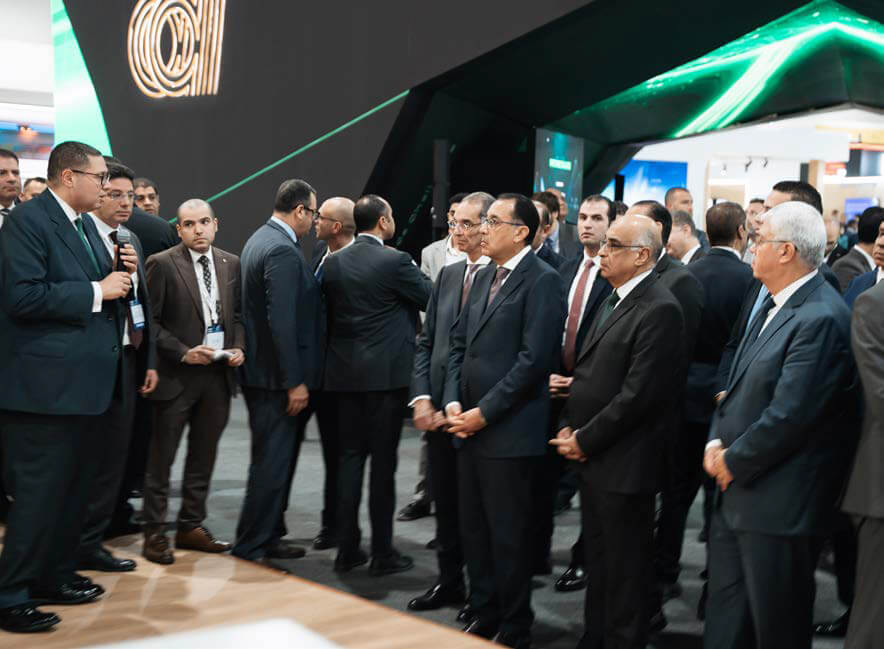

Cairo ICT has managed through the years to attract officials from Egypt, foremost the President, and elsewhere, including cabinet ministers, heads of regional and international organizations.